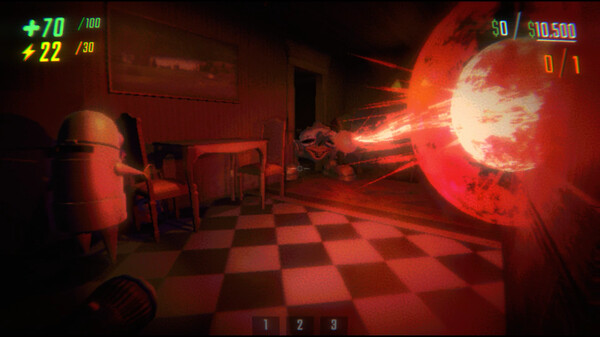

R.E.P.O.

All trademarks belong to their respective owners.

Sponsored Content

Access our exclusive HTML5 game collection

Image source - play.google.com

Advertisement

Advertisement

See more from the official digital markets

All trademarks belong to their respective owners.

Latest Posts

Latest Reviews

-

REMATCH

REMATCH is an exciting and competitive strategy game where every match is a chance to improve and win. Face your opponents in fast-paced rounds, adapt your tactics, and prove your skills in thrilling rematches. Whether you play with friends or challenge others online, REMATCH keeps you coming back for more action and fun!

Read full review

REMATCH

REMATCH is an exciting and competitive strategy game where every match is a chance to improve and win. Face your opponents in fast-paced rounds, adapt your tactics, and prove your skills in thrilling rematches. Whether you play with friends or challenge others online, REMATCH keeps you coming back for more action and fun!

Read full review

-

Dead By Daylight

Dead By Daylight blends horror with value—digital losses spark calls for insurance and player claims.

Read full review

Dead By Daylight

Dead By Daylight blends horror with value—digital losses spark calls for insurance and player claims.

Read full review

-

Poppy Playtime 4

Poppy Playtime 4 blends horror with corporate themes, revealing dark truths about insurance and claim fraud.

Read full review

Poppy Playtime 4

Poppy Playtime 4 blends horror with corporate themes, revealing dark truths about insurance and claim fraud.

Read full review

-

Poppy Playtime 3

Poppy Playtime 3 reveals corporate horror, unethical claims, and deeper narrative twists in a chilling sequel.

Read full review

Poppy Playtime 3

Poppy Playtime 3 reveals corporate horror, unethical claims, and deeper narrative twists in a chilling sequel.

Read full review

-

Poppy Playtime 2

Read full review

Poppy Playtime 2

Read full review

-

Schedule I

Schedule I rules affect insurance and claims due to legal status, coverage limits, and reform efforts.

Read full review

Schedule I

Schedule I rules affect insurance and claims due to legal status, coverage limits, and reform efforts.

Read full review